Retiree Medical Insurance and Pharmacy Resources

Medicare Supplement Insurance Plan F Summary of Benefits & Coverage (Florida Residents)

Medicare Supplement Insurance Plan F Summary of Benefits & Coverage (Non-Florida Residents)

Medicare Supplement Insurance Plan G Summary of Benefits & Coverage (Florida Resident)

Medicare Supplement Insurance Plan G Summary of Benefits & Coverage (Non-Florida Resident)

Retiree Medical Insurance & Pharmacy

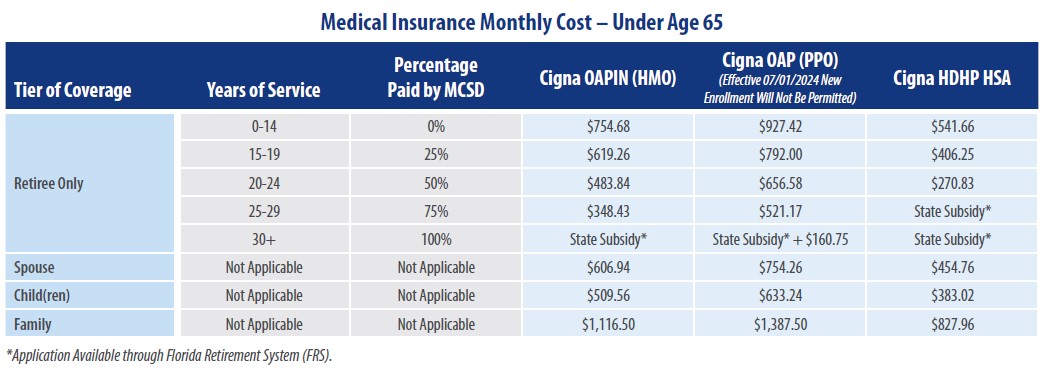

MCSD seeks to provide the best possible medical and prescription drug benefits at a reasonable cost. Retirees under the age of 65 or Not Medicare eligible are provided with three medical plan options through Cigna:

Cigna OAPIN

Cigna OAP (no new enrollment)

Cigna HDHP HSA (High Deductible Health Plan with Health Savings Account)

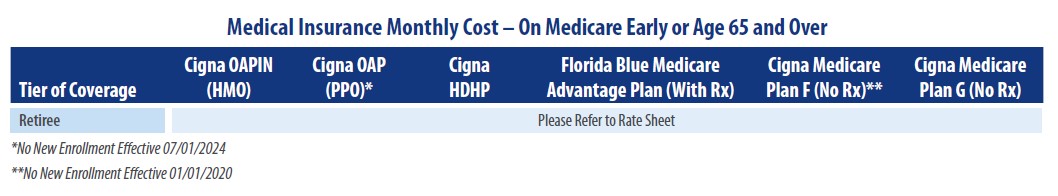

Retirees age 65 or Medicare eligible are provided with the following medical plan options:

Cigna OAPIN

Cigna OAP (no new enrollment)

Cigna HDHP

Florida Blue Medicare Advantage Plan (with Rx)

Cigna Medicare Supplement Plan F (No Rx) (no new enrollment)

Cigna Medicare Supplement Plan G (no Rx)

Under the Age of 65 and Not Medicare Eligible

For retirees under the age of 65 and not Medicare eligible, the School Board will pay a percentage of MCSD's flat amount contribution (as per School Board policy) toward the cost of single health insurance coverage. Please refer to rate sheets.

Age 65 and Over or Medicare Eligible

For retirees age 65 and over or Medicare eligible, retiree must have 15 or more years of service with the MCSD, prior to June 30, 2011, and retired between December 31, 2015 and June 30, 2025, the School Board will provide a Martin County Health Insurance Subsidy (MCHIS) in the amount of $5 per month for each year of service with the MCSD, for a maximum of 30 years of service.

Example:

An employee retiring after 15 years of service would receive $5 x 15 = $75/month MCHIS;

an employee with 22 years of service would receive $5 x 22 = $110/month MCHIS;

an employee with 30 years of service would receive $5 x 30 = $150/month MCHIS.

Please Note: For more information about retiree insurance contributions, please refer to School Board Policies 6560 and 6561.

Health Savings Account (Available with High Deductible Health Plan Only)

The Cigna HDHP with HSA complies with the Internal Revenue Service (IRS) requirements and qualifies enrolled retiree to open a Health Savings Account (HSA). Retiree must be enrolled in the Cigna HDHP with HSA to be eligible for the HSA. Retiree must be under age 65 to enroll in the HSA. An HSA provides retiree with a way to take ownership of healthcare dollars and help retiree build health savings to control out of pocket costs. HSA pre-tax funds can be used immediately to pay for current and future qualified expenses such as copays, deductibles, coinsurance and other qualified medical expenses. Retiree must re-elect the dollar amount they choose to have deducted each plan year.

HSA Contributions

2025 IRS maximum contribution limitations: $4,300 (individual coverage) and $8,550 (family coverage).

Account holder 55 years of age and older may contribute an additional $1,000.

Funds can accumulate from year to year. There is no maximum on how much the account balance can grow. This means there are no use-it-or-lose it rules with an HSA.

If retiree is enrolled in Medicare, TRICARE or TRICARE for Life, retiree is not eligible to contribute funds into an HSA.

Guidelines regarding the HSA are established by the IRS.

Important HSA Information

Contributions to retiree's account are tax free.

Interest and earnings are tax free.

Spending is tax-free when retiree pays qualified expenses from retiree's HSA account.

If retiree enrolls in the Cigna HDHP with HSA plan, an HSA will be automatically opened in retiree's name, if under 65. Any contribution to the HSA account is the responsibility of the retiree.

Retiree may not be covered under another health plan that is not a high deductible health plan, including a plan retiree's spouse may have where the spouse has elected family coverage.

Retiree owns the HSA funds from day one and can use the funds for qualified medical, dental, vision and prescription expenses.

HSA funds can be used for dependents even if the dependent is not enrolled in the retiree’s group insurance plan(s) as long as dependent is a qualified tax dependent and it is used for a qualified health care expense.

An account holder will receive a HSA Bank Debit Card. In addition, retiree is able to request an additional card for retiree's dependent(s).

HSA Bank provides easy and flexible ways to manage retiree's HSA account and is available to help retiree with payments and deposits. To pay for qualified HSA expenses, retiree can use a HSA Bank debit card, retiree can reimburse themselves from retiree's HSA account or retiree can schedule provider payments and reimbursements for a later date online at www.mycigna.com, click on the Health Savings Accounts link located under the Spending Accounts tab and select Visit HSA Bank.